I had

the most interesting conversation the other day with a local Burgess Hill

accountant, who asked me about my articles on the Burgess Hill property market.

He was particularly interested with the graphs, facts and figures contained

within them – so much so he recommended his clients read them, as most of them

were either Burgess Hill homeowners, Burgess Hill landlords and a lot of the

time - both. However, one question that kept me on my toes was, “With so many House-Price-Indices, how do you

know which one to use and how can you calculate what is exactly happening in Burgess

Hill?”

To

start with, there are indeed a great number of these Indices, including the

Land Registry, Office of National Stats, Halifax, Nationwide and LSL to name

but a few. The issue occurs when these different house price indices give diverse

pictures of the state of the UK housing market. Whilst some indices measure the

average value of every property in the UK (sold or unsold), others measure the

average ‘price-paid’ of houses that happen to be sold over a fixed time scale; confusing

isn’t it!

A lot

of the variance between house price indices occurs because of the distinctive

ways in which the numerous indices endeavour to beat these issues. You see, the

biggest problem in creating a house-price-index when comparing and contrasting

with most other indexes (e.g. inflation

where the price a ubiquitous tin of Beans can easily be measured over the

months and years), is every home is unique and as Burgess Hill people are

only moving every 15 years, it appears the only thing that can be measured is the

price of property sold in a given month.

By

their very nature, all of the indices are only able to paint a picture of the

whole of the UK or, at best, the regional housing market. As I have said many times

in my articles on the Mid Sussex property market, it is important to look to

the medium term when considering house price inflation/deflation. Looking at

the month-to-month jumps, many indices look like one of those jumpy

lie-detector needles you see in the cold war movies!

I can

guarantee you in the coming few months, on a month-by-month basis, one or more

of the indices will say property prices will have dropped. Let me tell you, no

property market indices are representative of the housing market in the short

term. Many indices have shown a drop around the Christmas and New Year months,

even the boom years of 2001 to 2007 and 2013 to 2015.

So,

back to the question, how do we work out what is happening in the Burgess Hill

Property Market and can there be a Burgess Hill House Price Index?

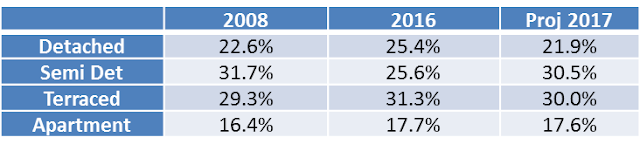

Then I look at the actual numbers of properties sold in the RH15 postcode district. Below is the graph with the numbers for the years already mentioned.

Then I look at the actual numbers of properties sold in the RH15 postcode district. Below is the graph with the numbers for the years already mentioned.

Finally, I amalgamated the same data points for the other postcode districts covered by Burgess Hill and the surrounding villages, weighted it accordingly, to produce the Burgess Hill House Price Index, which after all that work, currently stands at for Q4 2017 at 156.41 (Q4 2008 = 100).

No comments:

Post a Comment