On

several occasions over the last few months, in my Mid Sussex Property Blog, I

predicted that the rate of rental inflation (i.e. how much rents are rising by)

had eased over the last year. At the same time I felt that in some parts of the

UK rents had actually dropped for the first time in over eight years. Recent

research backs up this prediction.

Rents

in Mid Sussex for new tenancies fell by 0.4% in the last 12 months (i.e. not existing tenants experiencing

rental increases from their existing landlord). When we compare that current

rate with the historical rental inflation in Mid Sussex, an interesting pattern

emerges.

·

2016

- Rental Inflation in Mid Sussex was 5.1%

·

2015

- Rental Inflation in Mid Sussex was 9.4%

·

2014

- Rental Inflation in Mid Sussex was 3.2%

The

reason behind this change depends on which side of the demand/supply equation

you are looking from. On the demand side (from

the tenants’ point of view) there is the uncertainty of Brexit and the fact

that salaries are not keeping up with inflation for the first time in three

years. Critically this means tenants have less disposable income to pay their

rent. As an aside, it is interesting to note that nationally, rent accounts for

29% of a tenant’s take home pay*.

On

the supply side of the equation (landlords

point of view) Brexit also creates uncertainty. However, the biggest issue

was a massive upsurge of new rental properties coming on to the market in late

2016, caused by George Osborne’s new 3% stamp duty tax for landlords in the

first part of 2016. This meant a lot of new rental properties were ‘dropped’ on

to the rental market all at the same time. The greater choice of rental

properties for tenants curtailed rental growth/inflation. A slight softening of

Mid Sussex property prices has compounded this.

Figures from The Bank of England suggested that first time buyers rose over

the last 12 months as some were more inclined to buy instead of rent. Together,

these factors played a part in the ongoing moderation of rental growth.

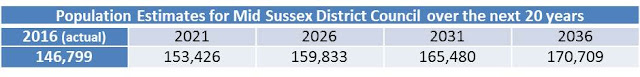

The

lead up to the General Election in May didn’t help: after all people don’t like

doubt and uncertainty. So now that we have a mandate for going forward over the

next 5 years hopefully that has removed any stumbling blocks stopping tenants

making the decision to move home.

Whether

it be ‘hard’ or ‘soft’ Brexit negotiations (and with the Election result the

Tory’s might have to be ‘softer’ on those negotiations) the simple fact is, we

aren’t building enough properties for us to live in. Both in Mid Sussex, the South

East and the wider UK, long-term population trends imply that rents will soon

be growing faster than inflation again. Look at the projections by the Office

of National Statistics;

Tenants

will still require a vibrant and growing rental sector to deliver them housing

options in a timely manner. As the population grows in Mid Sussex, and wider

afield, any restriction to the supply of rental properties (brought about by poor

returns for landlords) cannot be in the long-term best interest of tenants.

Simply put rents must go up!

The

fact is that I see this as a short-term blip

and rents will continue to grow in the coming years. With rents only accounting

for 29% of a tenants’ disposable income, the ability for most

tenants to absorb a rent increase does exist.

No comments:

Post a Comment